Streamline Loan Administration

Private credit collateral data often lacks cohesion, with inconsistent attributes. Bridgify consolidates these datasets from various sources, saving you time on digesting diverse data points.

Learn About Data Centralization

Stay Informed on Key Events

Compliance and monitoring can easily slip through the cracks. Bridgify automates workflows, providing real-time anomaly alerts and capturing user logs. Integration with top third-party databases like Bloomberg Law and Redfin further allows real-time updates on collateral, ensuring you’re always up-to-date.

Streamlined Loan Administration

Traditional loan management is labor-intensive and error-prone. Bridgify simplifies administration, ensuring data accuracy across diverse loan scenarios with user-friendly tools.

Start with Loan Admin

Efficient Investor Reporting

Investor reporting requests often require extensive data pulls and custom reports. Bridgify’s advanced reporting allows for custom analysis, dashboard creation, and easy sharing with investment partners.

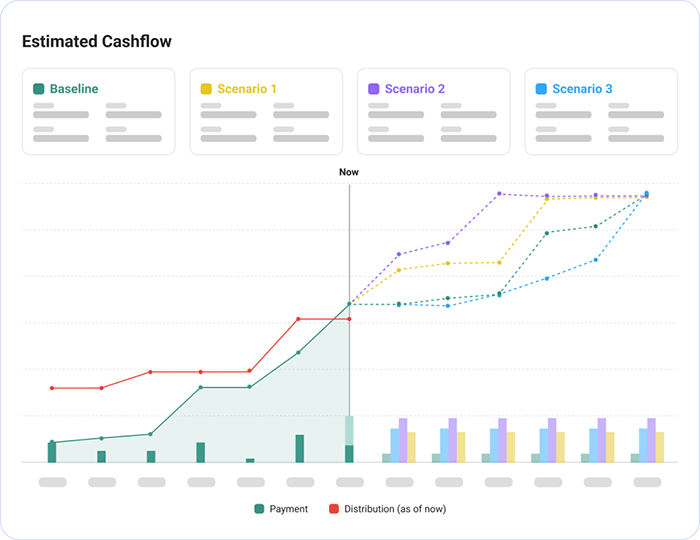

Instant Risk Adjustments

The bespoke nature of private credit complicates risk assessment. Bridgify offers scenario modeling for refined risk evaluations and strategic planning within simple steps.

Create Multiple Scenarios

Boost Your Alpha No Matter

Where You Are

Where You Are

Litigation Finance

Streamline case management, track case-level data, and receive real-time legal updates to optimize returns on litigation-backed investments.

Real Estate

Easily monitor property-backed assets, assess collateral health, and automate data consolidation for informed decision-making in real estate credit.

Healthcare

Navigate complex healthcare portfolios with tools for tracking compliance, performance metrics, and risk management specific to healthcare-backed credit.

Corporate

Manage corporate credit portfolios with real-time insights into financial health, creditworthiness, and risk exposure, tailored to corporate lending needs.

Venture

Support high-growth ventures with tools for tracking investment performance, scenario planning, and risk assessment in dynamic venture-backed credit.

Family Office

Hedge Fund

Private Credit

Private Equity

Trust Fund

Since Our Inception

in 2023

2 + billion

Total AUM

200,000 +

Total Line of Assets

Effortless Onboarding in No Time

Demo (30-min)

Schedule a 30-minute call with us for a walkthrough of Bridgify.

Setup (1-hour)

Discuss with our experts to customize and design your system structure.

Data Onboarding

we'll handle the data cleaning and ingestion, typically taking just a few business days.

Activation (30-min)

Get a full demo with your own data and start monitoring the performance!

Questions & Concerns

How does the data onboarding and migration process work?

Our onboarding team, composed of product managers and data engineers, handles your data migration from start to finish. We use structured data mapping and validation tools to ensure accurate and efficient transfer of historical data, including transactional and collateral records, with minimal downtime.

What types of integrations does Bridgify support?

Bridgify offers various integration options including Open API, Excel import, and secure SFTP file transfers. Our Open API enables seamless data exchange with fund management and reporting systems, while SFTP supports secure, automated batch uploads of large datasets.

I’ve just raised a fund and haven't deployed any capital yet. Do I still need Bridgify?

Yes, starting with Bridgify early enables you to set up a structured collateral and loan management process. This gives you a clear framework for underwriting and tracking as your fund grows, establishing standards that streamline operations and ensure data accuracy from day one.

We already use a fund administration system. What sets Bridgify apart?

Bridgify goes beyond traditional fund administration by integrating loan and collateral data in real time, with key metrics like LTV, IRR, and MOIC updated instantly through one-click adjustments. This eliminates the need for external spreadsheets and enables comprehensive portfolio monitoring from a single interface. Additionally, Bridgify places a stronger emphasis on collateral monitoring, providing specialized tools to manage collateral valuations and monitor risk with greater precision.

Can Bridgify handle complex loan structures and custom terms?

Yes, Bridgify’s loan admin engine supports custom deal terms, including variable rates, tiered repayments, and multi-collateral arrangements. The system’s flexibility allows precise management of complex deals, ensuring accurate calculations and real-time updates.